Natural Gas Rate

(Expiry: 27-May-2025 | Exchange: MCX | Head: Oil & Energy)02.03PM IST | 06 May, 2025

- 306.5Per 1 mmBtu

- Change

6.50 (2.17%)

- Volume7554

- Open304.9

- Prv. Close300.00

- Spot230.40

Day's Trend

- Day:

- Contract:

- Average Price (Rs/1 mmBtu):305.96

- Open Interest (Contracts):12045

- Open Interest Change %:2.82%

- Best Buy Price (Rs/QTY):306.4/15

- Prem/Disc:

- Spread:

- Unit:mmBtu

- Lot Size:1250

- Tick Size:10

- Best Sell Price (Rs/QTY):306.6/13

NATURALGAS News

Brent crude slips 0.35% to $80.51 as investors eye Trump move on Russian export curbs | News

14 Feb, 2025, 05.43 PM

Oil prices fell on Monday as expectations of U.S. President-elect Donald Trump relaxing curbs on Russia's energy sector in exchange for a deal to end the Ukraine war offset concern of supply disruption from harsher sanctions.

OPEC trims 2024 oil demand growth forecast to 1.93 million bpd | News

13 Feb, 2025, 07.52 PM

OPEC on Monday cut its forecast for global oil demand growth in 2024 reflecting data received so far this year and also lowered its projection for next year, marking the producer group's third consecutive downward revision.

Oil climbs over 1% after slide as US inventory drop, storm support | News

13 Feb, 2025, 08.14 PM

Oil prices rose over 1% on Wednesday, recovering some losses from the previous day. A drop in U.S. crude inventories and concerns about Hurricane Francine affecting U.S. output countered worries about weak global demand. Brent crude futures increased to $70.29 a barrel, while U.S. crude futures reached $66.86.

Oil prices rebound on fears of supply disruption from tropical storm | News

13 Feb, 2025, 08.14 PM

Crude oil prices rose on Wednesday as concerns about Tropical Storm Francine disrupting supply outweighed demand worries. Brent crude futures increased to $69.58 a barrel, while U.S. crude futures reached $66.19 a barrel. The storm has led to the suspension of some production facilities in the Gulf of Mexico.

Closing prices for crude oil, gold and other commodities | News

13 Feb, 2025, 12.04 PM

Oil prices dip while gold and silver see an increase. Currency exchange rates fluctuate slightly. Stay updated on the latest market trends.

Hedge funds rebuild oil position after OPEC⁺ round trip: Kemp | News

13 Feb, 2025, 12.18 PM

Navigating through diverse commodities, my investment strategy adapted to changing market conditions. From crude oil to natural gas, I observed shifts in positions and prices, reflecting resilience and caution. The market's response to OPEC+ reassurance and high inventories showcased a dynamic landscape, with investors strategizing for potential opportunities and challenges ahead.

OPEC switches to 'call on OPEC+' in global oil demand outlook, sources say | News

13 Feb, 2025, 08.41 PM

OPEC will stop publishing a calculation of the world's demand for its own crude in its monthly oil report, two sources close to the matter said, focusing instead on forecasts for demand for oil from the wider OPEC+ group.

Oil slips after rally last week on Middle East, tight supply | News

12 Feb, 2025, 06.17 PM

Oil prices slipped on Monday as investors indulged in some profit-taking after both benchmarks ended last week about 6% higher on Middle East tensions and as refining outages squeezed refined products markets.

Natural gas prices shed over 24% since January. What’s next? | News

12 Feb, 2025, 06.18 PM

A shortage in demand caused by above-normal temperatures in key consumers like the US and Eurozone, the industrial slowdown in Europe, and record-high production and exports from the US depressed prices across the globe.

Oil slips about 1% despite Middle East conflict | News

12 Feb, 2025, 06.35 PM

GLOBAL-OIL/ (UPDATE 4)UPDATE 4-Oil drops more than 1% despite Middle East conflict

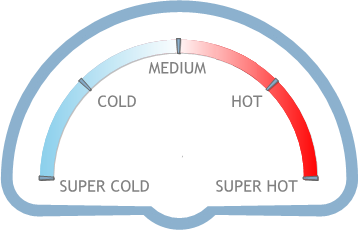

Hot/Cold Natural Gas Contract

NATURALGAS (MCX)

27 May 2025

NATURALGAS Spot Rate Details

NATURALGAS vs Other Oil & Energy

Trend

D | M | YNATURALGAS vs Peers (Intraday Range)

LowestHighest

02.28

2.23

NATURALGAS vs Peers (Contract Range)

LowestHighest

-23.0718.91

-2.01

NATURALGAS (25-Jun-2025) vs NATURALGAS Other Contracts

NATURALGAS Contract Details (2025-05-27) Exchange: MCX

Symbol

NATURALGAS

Contract Start Date

2024-11-26

Last Trading Date

2025-05-27

Lot Size

1250

Tick Size

10

Symbol Description

NATURAL GAS

Delivery Start Date

2025-05-27

Delivery End Date

2025-05-27

Symbol Info

NATURAL GAS

Tender Period Start Date

2025-05-27

Tender Period End Date

2025-05-27

Commodity Group

Oil & Energy

Name Of Underlying

Oil & Energy

Identifier of the Underlying

401

Instrument Identifier

444205

Instrument

FUTCOM

Expiry Date

2025-05-27

Price Quote Qty

mmBtu

Daily Price Percent

0.00

Near Month Instrument Identifier

-1

Far Month Instrument Identifier

-1

Trading Unit

mmBtu

Delivery Unit

mmBtu

NATURALGAS Rate Historical Performance

Future Margin Calculator

This is the minimum amount which is required to buy "x" number of lots of a particular commodity to trade in futures market.

Mark-to-Market Calculator

This is daily gain/loss on the position which is taken in derivatives market, it is calculated on daily basis till the time that position is not squared off.