- News

- Business News

- India Business News

- India Q3 GDP Data FY25 Highlights: Real GDP grows at 6.2% in third quarter; full year growth seen at 6.5%

India Q3 GDP Data FY25 Highlights: Real GDP grows at 6.2% in third quarter; full year growth seen at 6.5%

Economists are of the view that the worst is behind, and the Indian economy will continue to be the fastest growing major economy in the world in the coming quarters as well. The International Monetary Fund's latest global growth projections indicate India's economic expansion at 6.5% during FY25 and FY26. This positive outlook stems from strong consumer demand within the country, substantial infrastructure development initiatives and effective policy measures implemented by the government. Track TOI’s live coverage to know the latest on India’s Q3 GDP growth data:

The complexity of risks from tariff actions – already initiated and likely to be followed by more such measures in the coming months – is evolving and creates a downside bias to our forecasts.

Dharmakirti Joshi, Chief Economist, Crisil Limited

GDP Data Growth Live: Per Capita Income

The Per Capita Net National Income, also known as Per Capita Income, calculated at current prices, shows figures of Rs 1,69,145 for 2022-23 and Rs 1,88,892 for 2023-24.

GDP Data Growth Live: GDP growth slows compared to last year same quarter

India's economic expansion slowed to 6.2 per cent during the October-December quarter of the current fiscal year, primarily attributed to underperformance in mining, manufacturing and other sectors, whilst agriculture showed positive results. The economy demonstrated improvement when compared to the previous quarter's growth rate of 5.6 per cent.

According to data published by the National Statistical Office (NSO) on Friday, the GDP (gross domestic product) had registered a growth of 9.5 per cent during the October-December 2023 quarter.

India GDP Growth Live: Fiscal deficit reaches 74.5% of target

The government's fiscal deficit reached 74.5 per cent of the yearly target by January 2025, as per the Controller General of Accounts (CGA) data published on Friday. The actual fiscal deficit, which represents the difference between government spending and income, stood at Rs 11,69,542 crore for the period spanning April-January 2024-25.

For the corresponding period in the previous year, the deficit had amounted to 63.6 per cent of the Revised Estimates (RE) of 2023-24.

India GDP Growth Live: ‘Post COVID recovery was clearly underestimated earlier’

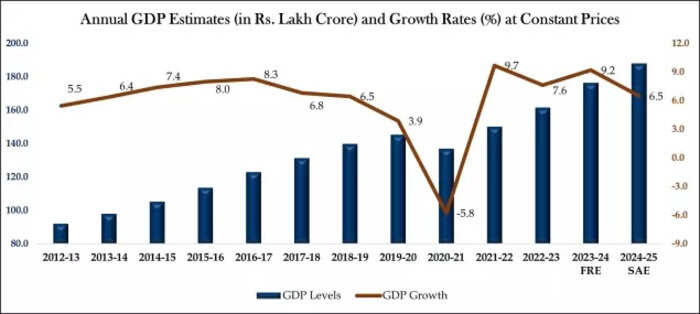

National accounts data released on 28 February 2025 by NSO relate to both 3Q 2024-25 and revisions of earlier releases covering 2022-23 to 2024-25. According to these revisions, the real as well as nominal growth curves have been lifted upwards. Real GDP growth rates for 2022-23 to 2024-25, are now estimated at 7.6%, 9.2% and 6.5% respectively. This shows a sharp fall in real GDP growth from 2023-24 to 2024-25 of nearly 2.7% points. The nominal growth curve has also been lifted upwards as compared to earlier estimates, showing healthier growth rates of 14%, 12% and 9.9% respectively in these three post COVID years. Thus, the post COVID recovery was clearly underestimated earlier, says DK Srivastava, Chief Policy Advisor, EY India.

GDP Data Growth Live: India's economic resilience

According to Hemant Jain of PHDCCI, India's 6.2% growth in Q3 FY 2024-25 demonstrates the nation's economic resilience and policy effectiveness.

Q3 FY25 witnessed agriculture and allied sectors achieving 5.6% growth, which is anticipated to enhance rural development, agricultural productivity and farmers' earnings, noted Jain.

The tertiary sector demonstrated remarkable performance with 7.4% growth in Q3 FY25. Notable growth of 6.7% was observed in services including trade, hotels, transport, communication, and broadcasting services, according to Jain.

He highlighted that this growth pattern indicates a dynamic services sector that is expanding whilst creating employment opportunities and fostering economic development.

Consumer spending showed positive trends with private final consumption expenditure increasing by 6.9% in Q3 FY25, indicating robust demand patterns.

A steady 3.5% growth in manufacturing reflects the positive impact of India's industrial sector reforms.

He noted that the construction sector maintained strong momentum with 7% growth in Q3 FY25.

This sector contributes significantly to employment generation across skill levels whilst supporting infrastructure development, he emphasised.

Utility services, including electricity, gas, and water supply, grew by 5.1% in Q3 FY 2024-25, providing essential support to manufacturing through improved infrastructure. He pointed out that India's gross fixed capital formation (GFCF) at 27.6% of GDP for Q3 FY25 indicates ongoing capacity expansion in the economy.

India GDP Growth Live: Analysing the GDP data

“GDP for FY24 was revised up by 100 bps. At 9.2% yoy, FY24 recorded the highest growth in 12 years (except for post-COVID year). A significant upward revision in last year’s figures has raised the base for this year’s growth calculations. Growth at 6.2% in Q3 FY25, as against 9.5% last year, appears to be a decent growth. Thankfully, growth in private consumption (6.9%) and government spending (8.3%) were strong, which should send a strong signal to investors, who now have the appetite for investing as corporate profits remained strong in Q3. This should also boost the manufacturing sector, whose growth has remained modest (at 3.5% in Q3).

Despite the volatility in the global market during Oct-Dec quarter, exports performed considerably well at 10.4%. Notably, the third quarter of FY 2025 saw a prominent increase in exports of engineering goods, electronics items, drugs and pharmaceuticals, and inorganic chemicals—the highest-ever exports recorded in history. The depreciation in currency against the dollar probably boosted exports. On the other hand, imports have contracted for three subsequent quarters despite currency depreciation.

Consumer spending remained high, and with signs of becoming more broad-based. Strong agriculture output growth (5.6%) helped keep rural demand resilient. Key high-frequency indicators, such as GST (8.3%) and registration of vehicles (11.75%), show healthy spending activities. The total number of ITR filers has grown to over 9.05 crore, marking a 6.8% increase compared to the previous fiscal year, indicating more individuals moving into the middle- and high-income brackets. With the tax exemptions aimed at boosting the consumption of the middle class, we expect spending to remain strong in the quarters ahead.

The fiscal deficit till Q3FY2025 was 56.7% of the budget estimate. Government has propped up spending, with Government capex utilization taking a big leap in December 2024 when it grew 61.7 percent of budgeted capital expenditures, up from 46.2 percent until November 2024. This should further crowd in private capex. Strong consumption and government capex will boost overall investment activity in India,” says Dr. Rumki Majumdar, Economist, Deloitte India.

India GDP Growth Live: Growth data

India's economic expansion slowed to 6.2 per cent during the third quarter of 2024-25, primarily attributed to weak performance in manufacturing and mining sectors. According to the National Statistical Office (NSO) data released on Friday, the nation's economy registered 6.2 per cent growth in the October-December 2024 quarter, compared to 9.5 per cent during the same period last year.

The country witnessed a growth rate of 5.6 per cent in the July-September quarter of the current fiscal year.

In its second advance estimate of national accounts, the NSO projected the nation's growth at 6.5 per cent for 2024-25.

The initial advance estimates released in January 2025 had forecasted a growth of 6.4 per cent for the current fiscal year.

Additionally, the NSO revised the GDP growth figures for 2023-24 upward to 9.2 per cent from the previous estimate of 8.2 per cent.

GDP Data Growth Live: Sector-wise growth rates of real GVA

India GDP Growth Live: ‘India must sustain 7.8 pc growth to reach high-income status by 2047’

A World Bank analysis indicates that India requires substantial reforms to maintain a 7.8 per cent annual growth rate to achieve high-income status by 2047. The report emphasises necessary improvements in financial sectors, land policies and labour markets.

The World Bank's India Country Memorandum, 'Becoming a High-Income Economy in a generation', acknowledges India's impressive growth trajectory, averaging 6.3 per cent from 2000 to 2024, establishing a solid foundation for future progress.

"However, reaching the ambitious target of becoming a high-income economy by 2047 will not be possible in a business-as-usual scenario... for India to become a high-income economy by 2047, its GNI (gross national income) per capita would have to increase by nearly 8 times over the current levels; growth would have to accelerate further and to remain high over the next two decades, a feat that few countries have achieved.

"To meet this target, given the less conducive external environment, India would need to not only maintain ongoing initiatives but in fact expand and intensify reforms," states the World Bank assessment.

India GDP Growth Live: Government expenditure grows significantly

Public expenditure increased by 8.3% during the fourth quarter of 2024, showing significant growth compared to the 3.8% rise observed in the third quarter.

Consumer expenditure in the private sector saw a robust growth of 6.9% compared to the same period last year, higher than the 5.9% growth recorded in the preceding quarter. This uptick was driven by stronger rural consumption, supported by lower food costs and heightened festival-related purchases compared to the previous year.

India Q3 GDP Data Growth Live: GVA growth in FY24

At the aggregate level, nominal Gross Value Added (GVA) at basic prices has increased by 11.2 per cent during 2023-24 compared to growth of 13.9 per cent during 2022-23. Real GVA, i.e., GVA at constant (2011-12) prices, has increased by 8.6 per cent in 2023-24, compared to 7.2 per cent growth in 2022-23.

India Q3 GDP Data Growth Live: 9.2% growth in FY24

Real GDP or GDP at constant (2011-12) prices for the years 2023-24 and 2022-23 stands at ₹176.51 lakh crore and ₹161.65 lakh crore, respectively, showing a growth of 9.2 per cent during 2023-24 as compared to growth of 7.6 per cent during 2022-23.

Nominal GDP or GDP at current prices for the year 2023-24 is estimated at ₹301.23 lakh crore, against ₹268.90 lakh crore for the year 2022-23, showing a growth of 12.0 per cent during 2023-24 as compared to growth of 14.0 per cent during 2022-23.

India Q3 GDP Data Growth Live: Shares of sectors in GVA

The shares of broad sectors of the economy in overall GVA during 2011-12 to 2023-24 and the annual growth rates during these periods are mentioned.

GDP Data Growth Live: Data compilation

The compilation of Second Advance Estimates of Annual GDP and Quarterly Estimates GDP follows the Benchmark-indicator methodology. This process involves extrapolating estimates from the previous financial year (2023-24) by utilising relevant sector performance indicators.

Real GDP has grown by 9.2% in the financial year 2023-24

According to the First Revised Estimates, the Real GDP registered a growth of 9.2% during the financial year 2023-24. This growth rate stands as the most significant in the past 12 years, with the sole exception being financial year 2021-22, which marked the post-covid recovery period.

GDP Data Growth Live: Real GVA estimates for Q3 FY25

Real GVA in Q3 of FY 2024-25 is estimated at ₹43.13 lakh crore, against ₹40.60 lakh crore in Q3 of FY 2023-24, showing a growth rate of 6.2%. Nominal GVA in Q3 of FY 2024-25 is estimated at ₹77.06 lakh crore, against ₹69.90 lakh crore in Q3 of FY 2023-24, showing a growth rate of 10.2%.

India GDP Growth Live: PFCE projections

Private Final Consumption Expenditure (PFCE) is expected to register a good growth of 7.6% during 2024-25 as compared to 5.6% growth observed during 2023-24.

India GDP Growth Live: Sector wise growth break-up

‘Construction’ sector is estimated to observe a growth rate of 8.6%, followed by ‘Financial, Real Estate & Professional Services’ sector (7.2%) and ‘Trade, Hotels, Transport, Communication & Services related to Broadcasting’ sector (6.4%) during 2024-25.

GDP Data Growth Live: FY24 saw 'highest growth in 12 years'

As per the First Revised Estimates, Real GDP has grown by 9.2% in the financial year 2023-24, which is highest in the previous 12 years except for the financial year 2021-22 (the post-covid year). This growth has been contributed by double-digit growth rates in ‘Manufacturing’ sector (12.3%), ‘Construction’ sector (10.4%) and ‘Financial, Real Estate & Professional Services’ sector (10.3%).

India GDP Growth Live: Real GVA estimates

Real GVA is estimated at ₹171.80 lakh crore in the year 2024-25, against the FRE for the year 2023-24 of ₹161.51 lakh crore, registering a growth rate of 6.4% as compared to 8.6% growth rate in 2023-24. Nominal GVA is estimated to attain a level of ₹300.15 lakh crore during FY 2024-25, against ₹274.13 lakh crore in 2023-24, showing a growth rate of 9.5%

India GDP Growth Live: GDP at Constant Prices

Real GDP or GDP at Constant Prices is estimated to attain a level of ₹187.95 lakh crore in the financial year 2024-25, against the First Revised Estimate of GDP for the year 2023-24 of ₹176.51 lakh crore. The growth rate in Real GDP during 2024-25 is estimated at 6.5% as compared to 9.2% in 2023-24. Nominal GDP or GDP at Current Prices is estimated to attain a level of ₹331.03 lakh crore in the year 2024-25, against ₹301.23 lakh crore in 2023-24, showing a growth rate of 9.9%.

India GDP Growth Live: Q2 GDP growth data revised to 5.6%

The growth rate of Real GDP for Q2 of financial year 2024-25 has been revised upward to 5.6%.

GDP Data Growth Live: FY25 growth seen at 6.5%

Real GDP has been estimated to grow by 6.5% in FY 2024-25. Nominal GDP is expected to witness a growth rate of 9.9% in FY 2024-25.

India GDP Growth Live: Real GDP grows at 6.2%

Real GDP is estimated to grow by 6.2% in Q3 of FY 2024-25. Growth rate in Nominal GDP for Q3 of FY 2024-25 has been estimated at 9.9%.

GDP Data Growth Live: What high frequency indicators suggest

“Available high frequency data for December 2024 and January 2025 continue to provide mixed signals about the growth momentum of the Indian economy. While the manufacturing PMI recovered to a sixmonth high of 57.7, services PMI fell to a 26-month low of 56.5 in January 2025 from their respective levels of 56.4 and 59.3 in December 2024. In fact, for the first time since November 2022, services PMI expanded at a rate slower than that of the manufacturing PMI, largely due to a significant moderation in the pace of expansion in new business activity. IIP growth fell to a three-month low of 3.2% in December 2024 from 5.0% in November 2024 due to moderation in the growth of manufacturing output. However, in 3QFY25, IIP growth was higher at 3.9% compared to 2.7% in 2QFY25, indicating an improvement in the industrial activity during the quarter. As per the data released by the Federation of Automobile Dealers Association, retail sales of motor vehicles recovered to show a growth of 6.6% in January 2025 from a contraction of (-)12.5% in December 2024. Within the vehicle segments, retail sales of passenger vehicles showed robust growth of 15.5% in January 2025 as compared to a contraction of (-)2.0% in December 2024. Retail sales of two wheelers also improved during the month with a growth of 4.2% in January 2025 as compared to a sharp contraction of (-)17.6% in December 2024. During April-January FY25, growth in retail sales of motor vehicles was at 8.4%, supported by strong growth rates of 10.0% in the sales of twowheelers and 5.6% in passenger vehicles,” says EY in its latest Economy Watch edition.

India GDP Growth Live: RBI sees challenges globally

The global economic backdrop remains challenging. The global economy is growing below the historical average even though high frequency indicators suggest resilience along with continued expansion in trade. Progress on global disinflation is stalling, hindered by services price inflation, said RBI governor Sanjay Malhotra in this month's monetary policy review.

India GDP Growth Live: SBI projects GDP growth

GDP Growth as per SBI composite leading indicator (CLI) Index (a basket of 36 leading indicators which includes parameters from almost all the sectors) based on monthly data shows a slight uptick in economic activity in Q3. This increase in economic activity in Q3FY25 indicate GDP may grow in the range of 6.2-6.3%

GDP Data Growth Live: ‘Indian economy leaning against the winds’

Despite upheavals in global geo-politics, and trade/supply chains being susceptible to winds of re-globalization, Indian economy has been leaning against the winds, says SBI in its recent research report.

The GDP growth for Q3 FY25 should come around 6.2%-6.3% (data due on 28th February)…presuming no major revisions announced in the erstwhile Q1 and Q2 figures by NSO, we estimate the FY25 full year GDP at 6.3%, says SBI.

The % of indicators showing acceleration has increased to 74% in Q3FY25 vs 71% in Q2FY25…Continuing the momentum, a healthy rural economy is further reinforcing stability and sustains momentum in other sectors even as rural agriculture wage growth is consistent and domestic tractor sales and rabi crop sown have picked up momentum.

GDP Data Growth Live: What RBI has said on inflation

Headline inflation, after moving above the upper tolerance band in October, has since registered a sequential moderation in November and December. Going ahead, food inflation pressures, absent any supply side shocks, should see a significant softening due to good kharif production, winter-easing in vegetable prices and favourable rabi crop prospects.

Core inflation is expected to rise but remain moderate. Rising uncertainty in global financial markets coupled with continuing volatility in energy prices and adverse weather events presents upside risks to the inflation trajectory.

Taking all these factors into consideration, CPI inflation for the current financial year is projected at 4.8 per cent with Q4 at 4.4 per cent.

Assuming a normal monsoon, CPI inflation for the financial year 2025-26 is projected at 4.2 per cent with Q1 at 4.5 per cent; Q2 at 4.0 per cent; Q3 at 3.8 per cent; and Q4 at 4.2 per cent. The risks are evenly balanced.

India GDP Growth Live: Agriculture in focus

During the most recent quarter (Q3 FY 2024-25), subdued consumer spending in urban areas likely affected the performance of manufacturing and service industries.

Agricultural production's robust performance, nonetheless, is anticipated to contribute positively to overall economic expansion.

GDP Data Growth Live: Impact of US tariffs?

India is expected to maintain its position as the fastest growing major economy, despite facing challenges regarding its trade relations with the U.S. and potential reciprocal tariffs proposed by the Trump administration.

Radhika Rao, an economist at DBS Bank, stated in a February 25 note that the immediate effects of tariffs on economic expansion could be minimal, though different sectors may experience varying consequences.

India GDP Growth Live: Lowest growth rate in four years?

Public spending likely exhibited a substantial double-digit increase in the October-December period, following a modest 4.4% uptick in the preceding quarter, with both central and state authorities accelerating their capital outlays.

The government will also unveil updated growth projections for the fiscal year concluding March 31. According to a Reuters survey, the Indian economy is expected to expand by 6.5% in 2024/25, slightly above the earlier official projection of 6.4%, though marking the lowest growth rate in four years.

We think the worst is over as far as India's growth trajectory is concerned but, even with the improvement of momentum, overall GDP growth is likely to remain below the potential growth rate of 7% in 2025-26

Deutsche Bank

GDP Data Growth Live: GDP growth outlook for FY26

The Modi government unveiled income tax slab rate changes for individual taxpayers during the Budget 2025 presentation in February. Under the new income tax regime, a salaried individual earning up to Rs 12.75 lakh will not have to pay any tax. The tax slabs and rates have also been revised, providing relief for individuals at higher income levels as well.

Under the leadership of its new governor Sanjay Malhotra, the central bank recently cut the repo rate by 25 basis points, relaxed liquidity measures and postponed stricter financial regulations to stimulate economic expansion.

Nevertheless, economic growth is projected to remain moderate, ranging between 6.3-6.8% in the fiscal year starting April, considerably below the 8.2% recorded in 2023-24, according to a Reuters analysis.

GDP Data Growth Live: What RBI governor said in the last policy statement

As per the first advance estimates, real GDP growth for the current year is estimated at 6.4 per cent, a softer expansion after a robust 8.2 per cent growth last year. Going forward, economic activity is expected to improve in the coming year. Agricultural activity remains upbeat on the back of healthy reservoir levels and bright rabi prospects. Manufacturing activity is expected to recover gradually in the second half of this year and beyond. Early corporate results for Q3 indicate a mild recovery in the manufacturing sector. Mining and electricity are rebounding from monsoon related disruptions in Q2. Business expectations remain upbeat, as evidenced from the PMI manufacturing future output index. Services sector activity continues to be resilient. PMI services, however, declined from its recent peak.

On the demand side, rural demand continues to be on an uptrend, while urban consumption remains subdued with high frequency indicators providing mixed signals. Going forward, improving employment conditions, tax relief in the Union Budget, and moderating inflation, together with healthy agricultural activity bode well for household consumption. Government consumption expenditure is expected to remain modest. Higher capacity utilisation levels, robust business expectations and government policy support augur well for growth in fixed investment.

Continued buoyancy in services exports will support growth. Global headwinds, however, continue to impart uncertainty to the outlook and pose downward risks. Taking all these factors into consideration, real GDP growth for the next year is projected at 6.7 per cent with Q1 at 6.7 per cent; Q2 at 7.0 per cent; Q3 at 6.5 per cent; and Q4 at 6.5 per cent. The risks are evenly balanced.

India GDP Growth Live: GVA growth projections

Economic output, measured through gross value added (GVA), which provides a more reliable indicator of growth, likely expanded by 6.2% year-on-year during October-December, compared to 5.6% growth in the preceding quarter.

"The improvement is led by a revival in rural demand and a rise in central government capital expenditure," Gaura Sen Gupta, chief economist at IDFC First Bank Economic Research told Reuters.

"Urban demand is also showing some signs of improvement, but the recovery remains relatively softer than rural demand," Sen Gupta said.

GDP Data Growth Live: What’s the GDP forecast?

India's economy likely showed improvement during October to December period, driven by enhanced rural consumption after favourable monsoon conditions and increased government expenditure.

The country, which ranks as Asia's third-largest economy, experienced a notable deceleration during July to September, with GDP expansion declining to 5.4%, marking the lowest rate in seven quarters. Economic experts attributed this downturn to subdued urban consumption and postponed government expenditure owing to last year's national polls.

For the quarter ending December, the gross domestic product is projected to have grown by 6.3% compared to the previous year, based on a Reuters' survey. However, this figure remains below the central bank's projected growth rate of 6.8%.

The IMF has emphasised the necessity of structural reforms in India whilst maintaining suitable policies for economic stability. The organisation highlighted risks to growth from geoeconomic division and reduced domestic demand, whilst projecting a 6.5% growth rate for FY25 and FY26.

The IMF board's Article IV consultation report praised Indian officials for their prudent economic management that enhanced growth. This creates an opportunity to implement vital but challenging structural changes needed to achieve the country's goal of becoming an advanced economy by 2047.

The IMF warned that broader conflicts, internally focused policies and diminished international cooperation could affect external demand, vital import supplies, trade expenses and FDI. The organisation suggested that India could address global fragmentation challenges through enhanced trade integration with partner nations.

The report outlined immediate priorities including labour market reform, reducing trade barriers, sustaining public investment and establishing robust policy frameworks for economic stability. It advised aligning financial sector regulations, supervision, resolution and safety measures with global standards.

Additional focus areas included reforms in agriculture, land use and judicial systems; enhancing education, skills development, public health and social protection; reducing state involvement in credit markets and other investment barriers; creating quality employment opportunities; and implementing environmental policies.